Environmental Commodity Partners is an emerging fund that invests in the budding carbon credit market. Neither the manager or the new asset class was well understood.

The Challenge

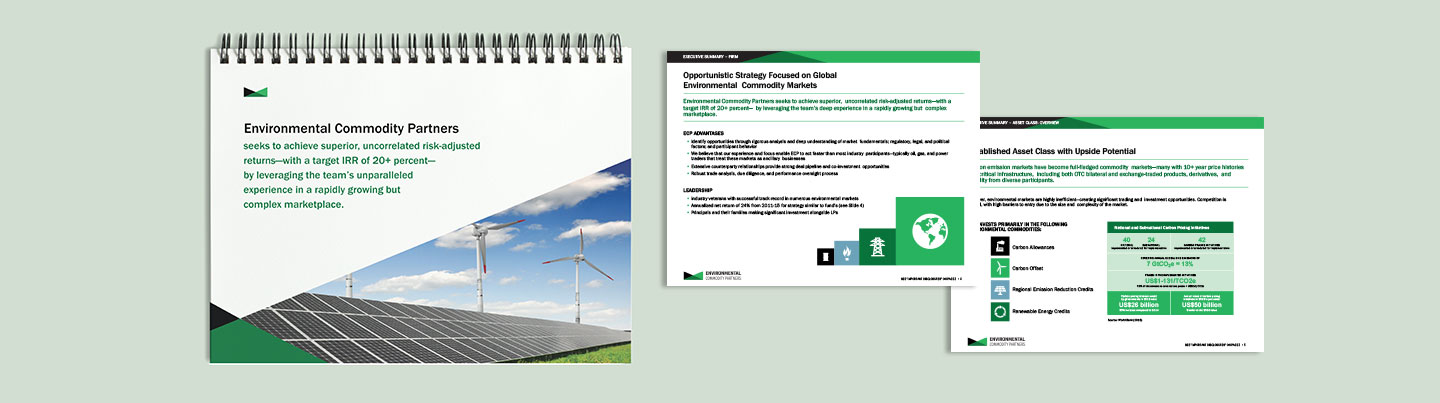

ECP’s founders engaged SPINE as they prepared to raise their inaugural fund. Launching a firm is challenging enough, particularly for emerging managers, but ECP faced another major hurdle: Environmental commodity markets are young and not broadly understood. On that first front, ECP needed the core components of a brand—including a name—and essential fundraising tools. All these materials would need to work together to build credibility while helping investors understand the asset class and its upside potential.

Corporate Identity

Naming the new firm was our first task. We spoke extensively with the team about the qualities they wanted to convey, and explored a broad spectrum of options. In the end, SPINE and ECP agreed the name needed to be straightforward and descriptive in this young and complex marketplace. Identity development came next. While environmental commodities are invisible, all of ECP’s investments help reduce pollution and improve quality of life. The logo illustrates this concept, while the crown shape suggests leadership—appropriate for a team of industry trailblazers.

“SPINE is a strong partner. We are expert at investing in environmental markets, while they are expert at developing a brand and marketing materials. Their work lent instant credibility and clarity to our story.” – Blake Schaefer, Partner

Stakeholders:

Prospective Investors

"Why invest in this asset class—and with ECP?"

Once we established the visual elements of the brand, SPINE worked closely with ECP to develop messaging that answered several key questions in a clear and compelling way. What are environmental commodities? Why is the asset class attractive? Who is ECP and why should I entrust my money to them? We then deployed the branding and messaging in marketing materials including the pitchbook, the centerpiece of any fund raise.

"Why invest in this asset class—and with ECP?"